At more than £96 billion a year, the State Pension is the UK’s largest benefit. Paid to more than 12 million people, the State Pension is a lifeline for many British pensioners.

While many retirees have made their own financial provision, though private pensions or other investments, the State Pension still forms an important part of your retirement planning.

Department for Work and Pensions figures show that benefits (including the State Pension) form around a third of all income for pensioner couples. So, ensuring you get the most from your State Pension is still hugely important to maintain the lifestyle you want after work.

Here are three essential things you need to know about the State Pension

1. You have to claim it

Generally speaking, you won’t automatically receive your State Pension when you reach pension age.

You will normally receive a letter from the Pension Service around 2-4 months before you reach State Pension age. This will explain how you can claim your State Pension online, by phone, or by post.

- Online – When you receive a letter about getting your State Pension, you can use the invitation code on the letter to claim online. You will need the date of your most recent marriage, civil partnership or divorce, the dates of any time spent living or working abroad and your personal or joint bank or building society details.

- By phone – To claim over the phone, call the Pension Service claim line on 0800 731 7898. Phone lines are open Monday to Friday, 8am to 6pm (except public holidays).

- By post – You can download a form online and return by post.

When you claim your State Pension you will need to provide your National Insurance number. You may also need to provide evidence of your date of birth.

If the Pension Service does not hear from you regarding claiming your State Pension, it will automatically defer your payments (see below).

Not claiming your State Pension could leave you out of pocket. The Daily Mirror recently showcased the case of 76-year-old Peter Williams, who believed he wasn’t entitled to any State Pension after not receiving a reply to the forms he submitted at age 65.

It transpires that the forms were lost and, when Peter’s equity release advisor got in touch with the Pensions Service, it emerged the former truck manager had not been receiving any payments.

Peter then discovered he was entitled to £274 a week, starting immediately, along with a £132,800 payment for all the unclaimed years.

Steve Webb, Director of Policy at insurer Royal London, says: “If you are over pension age and have not received anything, you should call the Pension Service.

“If it does not hear back, the Pension Service assumes that taxpayers want to defer their State Pension. But the letter may not have reached its destination.”

2. You don’t have to take it straight away

If you have other sources of income when you reach State Pension age, you don’t have to claim your State Pension straight away.

If you defer claiming your State Pension you may get additional State Pension when you decide to claim it. If you are claiming certain benefits, deferring your State Pension will not increase its value, so check whether this applies to you.

The amount of additional State Pension you receive will depend on how long you defer your claim.

You must defer for at least nine weeks. After this, your State Pension will increase by 1% for every nine weeks you put off claiming. This equates to just under 5.8% for every full year you put off claiming.

After you claim, the extra amount you get because you deferred will usually increase each year in line with inflation. The extra amount is paid with your regular State Pension payment.

Here’s an example.

- You get £168.60 a week (the full new State Pension)

- You decide to defer your claim for a year.

- You’ll get an extra £9.74 a week (just under 5.8% of £168.60)

- If there is an annual increase in the State Pension, the amount you could get could be larger.

3. You may be older by the time you come to claim it

A year ago, the State Pension age for men and women equalised to 65 (up from 60 for women). However, changes to the State Pension age are expected to happen in the future; indeed the transition to increasing the age to 66 has already begun.

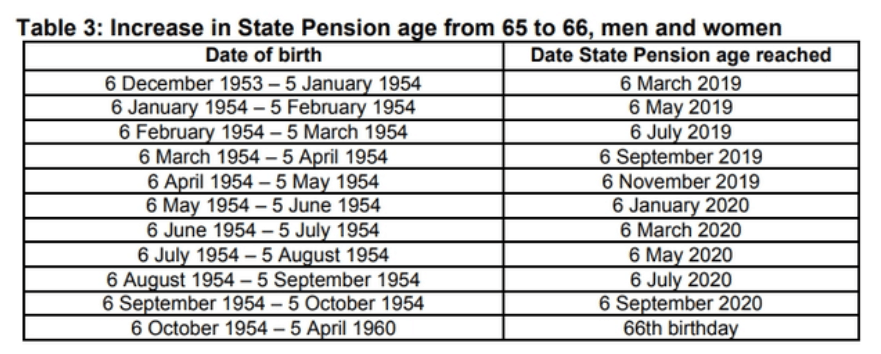

This increase to the State Pension age means that you may not receive your State Pension at the age you may have expected. For example, anyone who was born between 6 December 1953 and 5 January 1954 will not get their pension when they turn 65 and will instead have to wait up to three months to reach their official State Pension age on 6 March 2019.

Thereafter there will be incremental increases every three months through to October 2020 when everyone will receive their State Pension from age 66.

Further changes are expected to be rolled out between 2026 and 2028, when the State Pension age will move to 67.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Your pension income could also be affected the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Production

Production