A Treasury spending review released last month confirmed that the coronavirus crisis has so far cost the UK £280 billion.

The Chancellor’s Winter Economy Plan confirmed the government would continue to spend while the pandemic was ongoing, with an extension to the costly Job Retention (or ‘furlough’) Scheme and Tier 3 grants for struggling businesses.

In the new year, however, plans will be needed to recoup some of this massive overspend.

Back in the summer, Rishi Sunak called for a review into Capital Gains Tax (CGT) and the Office of Tax Simplification (OTS) recently released its recommendations. Other taxes are likely to be on the Chancellor’s radar too.

Here are some of the reforms we might see in 2021 and what they could mean for your finances.

1. Capital Gains Tax

Back in July, Rishi Sunak ordered a CGT review. The OTS has now returned with recommendations it says could double the number of people paying the tax; revenue that could total £70 billion over the next five years.

Here are three of its recommendations:

- A reduction to the current CGT Allowance

For the 2020/21 tax year, the CGT allowance is £12,300 for an individual. This represents the amount of profit you can make from an asset in a given tax year without having to pay CGT.

The recommendation from the OTS is that the allowance is dropped to between £2,000 and £4,000. The change could more than double the number of people paying the tax, raising an additional £14 billion a year.

- Aligning CGT with Income Tax

Income Tax rates currently stand at:

- 20% for Basic-rate

- 40% for higher-rate, and;

- 45% for additional rate taxpayers

Under the current system, however, a Basic-rate taxpayer is liable to CGT at 10% on asset sales. The figure is 18% on investment property sales or gains made on a second home.

If you’re a higher-rate taxpayer, you’re currently liable to CGT at 20% on asset sales and 28% on property sales.

A rise in line with Income Tax would clearly see a significant increase in CGT revenue.

- The removal of the Inheritance Tax (IHT) ‘uplift’

Under current IHT ‘uplift’ rules, if you inherit an asset it is valued at the date of death and you don’t pay any CGT on earlier gains.

Removing the ‘uplift’ means that an asset you inherit, such as an investment portfolio, for example, would be valued at its original amount, meaning you would become liable for CGT on gains made before you owned the asset.

2. Inheritance Tax

The All-Party Parliamentary Group for Inheritance & Intergenerational Fairness (APPG) suggested changes to IHT in January 2020.

This led to predictions of reform in March when Rishi Sunak delivered his first Budget as Chancellor.

No such changes occurred, but could the year’s coronavirus spending make IHT adjustments inevitable next year?

Two areas that might see changes in 2021 are:

- Intergenerational pension asset transfer

Under current pension legislation, any unused pension amount on death before the age of 75 stays outside of your estate for IHT purposes. This means 100% of it can be passed on to your chosen beneficiary.

If you die after the age of 75, your beneficiary pays tax on the amount they receive at their marginal rate of income tax.

Changes could see unused pension amounts counted towards the deceased’s estate, and therefore liable for IHT.

- The ‘seven-year’ rule

You can currently make gifts during your lifetime without them being liable for IHT, if you survive for seven years after making them.

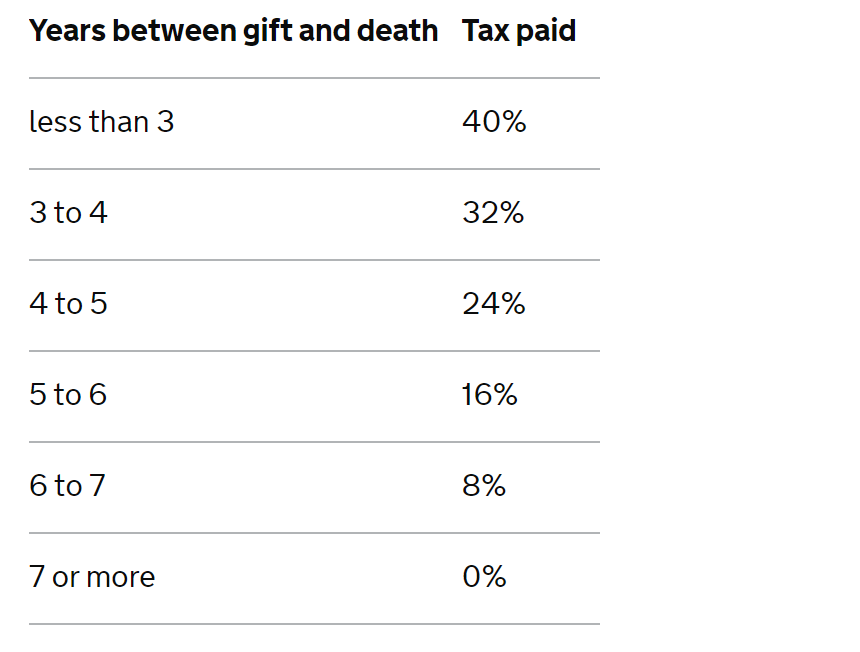

The IHT rate payable is measured on a sliding scale from 40% on death within three years of making a gift, with nothing to pay after year seven.

Source: Gov.uk

This rule could be removed and replaced by an annual allowance of £30,000, above which any gifts would be liable for IHT at 10%.

The APPG suggests that the new £30,000 allowance should replace all other gifting allowances, including the current £3,000 annual exemption and gifts made from excess income.

3. Income Tax

According to a recent BBC report, the government will raise £100 billion less in tax than expected this year, due to the coronavirus pandemic.

A freeze on Income Tax was a 2019 Conservative manifesto promise, but the impact of coronavirus and increased spending in 2020 could make a rise inevitable.

Although changes are unlikely to occur until a sustainable level of economic recovery is reached, changes for high and low earners alike could be on the cards.

Get in touch

A recent Guardian report confirmed that economists from four of the UK’s leading economic thinktanks believe that no significant changes should be made until a proper financial recovery takes hold.

Continued coronavirus borrowing makes it clear we’re not at that stage yet, but it also makes future reforms increasingly likely. Now might be the time to act.

If you would like to discuss your long-term financial plans and the potential impact of tax changes, please get in touch. Email at info@thepensionplanner.co.uk or call 0800 0787 182.

Production

Production