Recent volatility in the stock market has been well-documented. As the coronavirus pandemic took hold around the world global markets fell.

In March, the FTSE 100, the Dow Jones and the S&P 500 suffered their largest single-day drops since 1987. Two weeks later, the FTSE 100 followed that up with its second-highest one-day rise in history.

Short-term shocks to the market have occurred before – they are to be expected and anticipated. But it can still catch you off guard.

It is important to remember that your investments are highly diversified and intended for the long term. Avoiding knee-jerk reactions and emotional decisions, and keeping your funds invested, is the best way to see good returns in the long term.

The general trend of the stock market is an upward one. It’s a pattern we can see more clearly by looking at historic, long-term performance.

Stock market trends

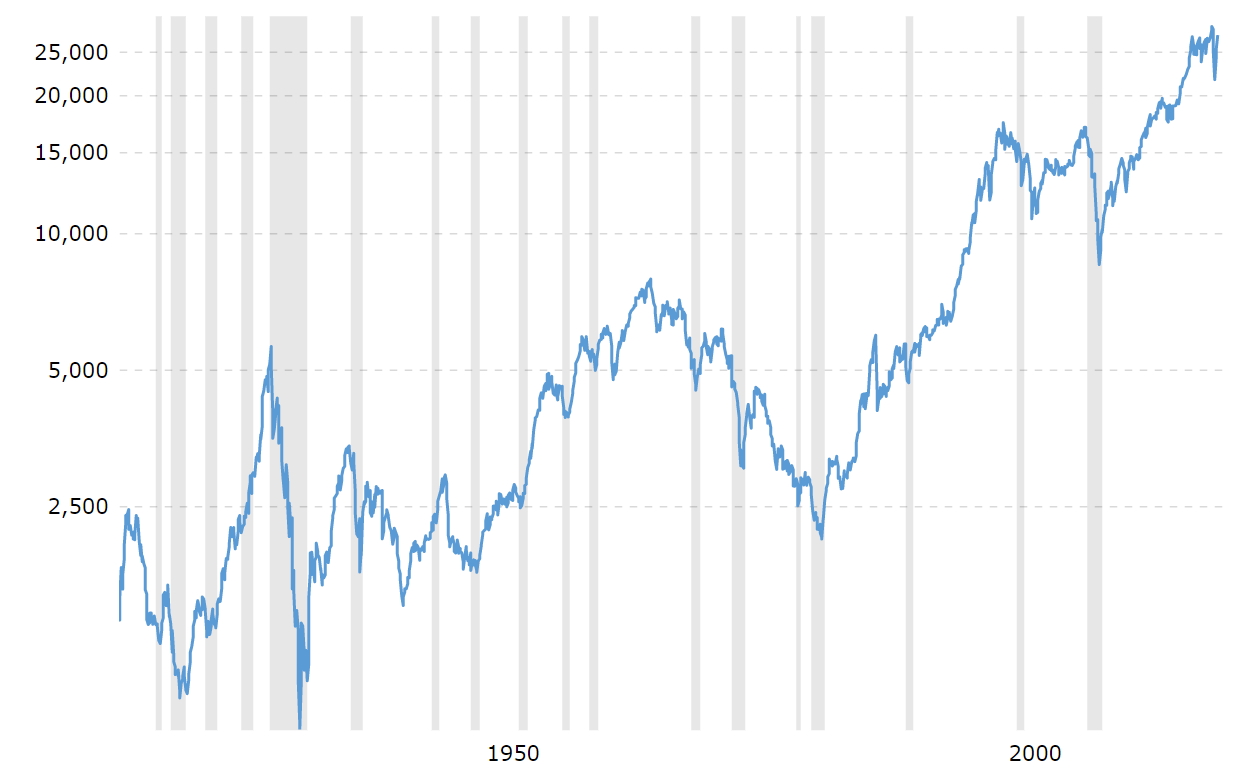

Historically, the Dow Jones has experienced a pronounced upward trend, as outlined on this graph tracking the index since April 1915.

Source: Macrotrends

The chart shows the Dow Jones Industrial Average (DJIA) stock market index for the last 100 years. Historical data is inflation-adjusted using the headline CPI and each data point represents the month-end closing value.

The FTSE 100 has shown a similarly pronounced trend.

This London Stock Exchange graph tracks the index since 1990. It shows the general upward trajectory, as well as numerous periods of short-term volatility.

Clearly visible are the dips caused by the 2008 global financial crisis and the events leading up to the 2003 invasion of Iraq.

We can also see the most recent dip, resulting from the coronavirus pandemic.

Source: London Stock Exchange

And yet IG confirms that over the last 25 years (up until 2019), total returns in the FTSE 100 index were 380.52% with dividends reinvested, or a 6.47% annualised return.

Remember that although this doesn’t take into account the most recent period of market volatility, it does include the bursting of the dot.com bubble, the war in Iraq, and a global financial crisis.

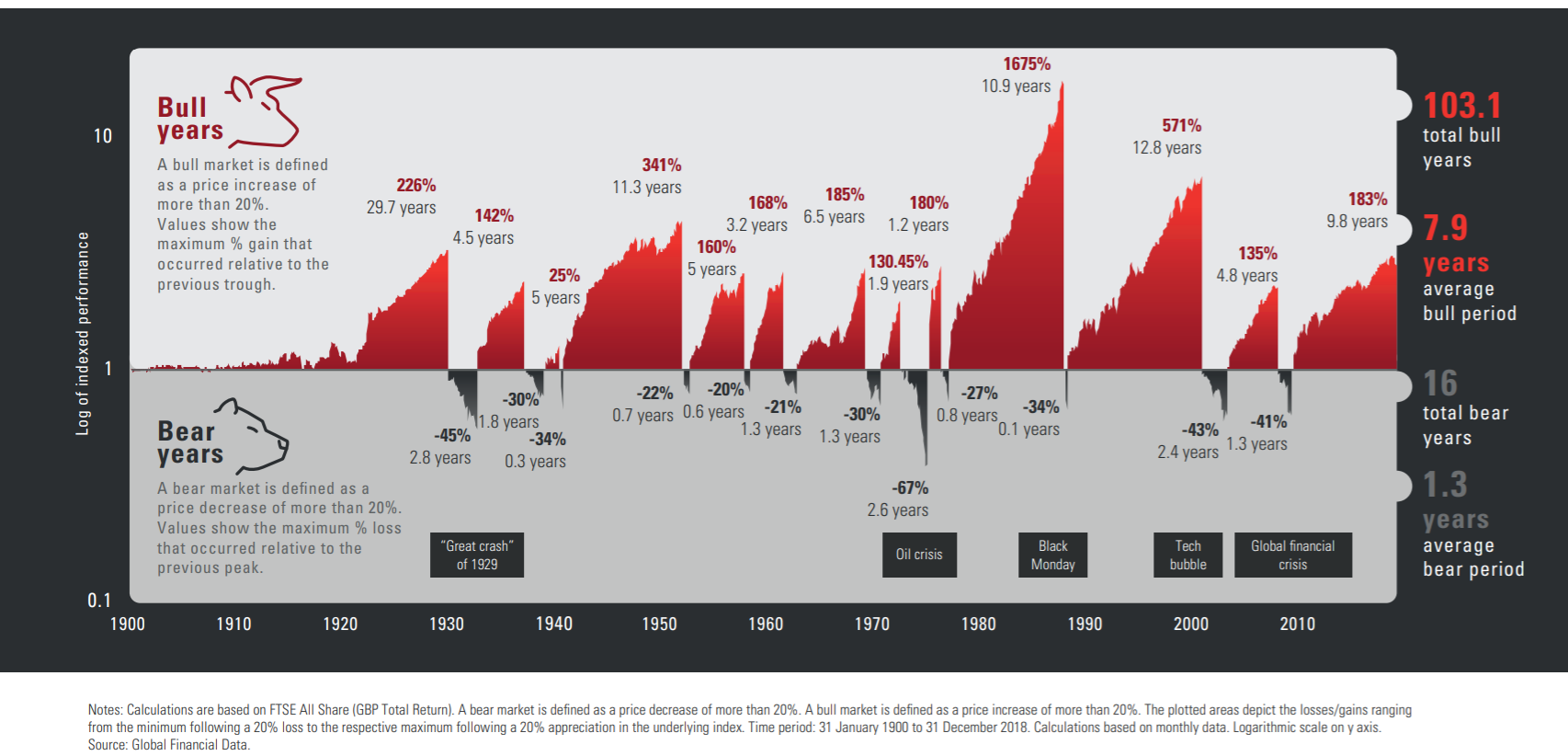

Source: Vanguard

Large stock market falls – whether to the overall market, a specific index, or an individual commodity – will have an impact on your investments, at least in the short-term. It is hoped that these periods will be short-lived and that a rise in stock prices will follow.

A breakdown of bull and bear markets in the UK over the last 120 years shows that during that period the number of bull years (103) greatly outweighs the bear years (16).

The average bull period lasted for almost eight years, whereas the average bear period lasted a mere 1.3 years.

What these trends mean for you

Your investments are intended to produce returns in the long term. That means keeping your money invested even when times are tough. It is hoped that you’ll reap the rewards later when the market recovers.

As we have seen, short-term volatility has occurred before. The reason for the economic downturn may be different on this occasion but the last 100 years show us that markets will react in the same way.

When investing over the long term, there are a few key things to remember:

- Ignore the noise

‘Noise’ in the context of stock market investment refers to the sort of global events already mentioned: the global financial crisis, the bursting of the dot.com bubble, Brexit, US-China trade wars, and most recently, the coronavirus pandemic.

All of the above have created periods of uncertainty and the stock market has reacted. Highly publicised drops in prices can be hugely worrying, that is why we are here – to reassure you, and to advise you against knee-jerk reactions to the noise.

- Time in the market is crucial

Your investments are intended for the long term so that they can take advantage of the generally upward trend of the market.

Investing with a long-term outlook means avoiding the temptation to try to time the market. It’s impossible to time the market consistently and you could find you miss some of the best market days. This can have large implications on your future investment amount.

- Diversified portfolios

Large stock market falls can be worrying but remember that it is unlikely that a drop in the FTSE 100 of a given percentage, will equate to the same level of drop in your investment portfolio.

This is because you won’t be invested solely in stocks and shares.

Your portfolio will be diversified to include other asset classes such as bonds and cash. You might also find that different sectors fare better or worse. The same is true of geographical areas.

By spreading the risk of your investments by diversifying across risk, asset class, sector and geographical area, you stand the best chance of riding out short-term volatility and making the most of the market recovery when it occurs.

Get in touch

If you are worried about the effect of short-term market volatility on your investments, please get in touch. Email at info@thepensionplanner.co.uk or call 0800 0787 182.

Please note:

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation, and regulation which are subject to change in the future.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation which is subject to change.

Production

Production