The coronavirus pandemic is believed to have created 6 million “accidental” savers. Between them, this group has accumulated wealth of over £150 billion and, as restrictions lift, it may be time to start spending.

With that in mind, a recent report has shown that the over-55s intend to live life to the full post-lockdown. And retirees’ bucket lists are dominated by world travel.

Keep reading to find out what bucket list activities over-55s will be ticking off and what you should do with your accidental savings to ensure you are able to achieve your retirement dreams.

The coronavirus pandemic created 6 million “accidental” savers

While for many – those who were furloughed or lost their job – the coronavirus pandemic has meant financial hardship and a struggle to make ends meets, for others, limited spending opportunities have translated into “accidental” savings.

According to figures published by the BBC, 6 million employees found it easier to save during the pandemic – specifically between March and November 2020.

Accidental saving was easiest for those on higher incomes who could continue to work from home. However, many young people benefited too, as their usual spending channels closed.

Recent figures suggest that more than £150 billion could have been squirreled away last year, although the Bank of England’s (BoE’s) chief economist, Andy Haldane, has suggested that the accidental savings pile could hit £250 billion by the end of this month.

While this post-lockdown spending spree has played a part in the improved economic forecast released by the BoE last month, it has also helped inflation to rise above the UK’s target of 2%. It reached 2.1% in May.

Brits are looking abroad for post-lockdown spending

“Freedom Day” might have been postponed, and foreign travel to many destinations remains off the cards, but that hasn’t stopped over-55 planning bucket list foreign holidays.

A new report from Royal London has found that 64% of over-55s plan to travel more once restrictions allow. The most popular bucket list experience is a visit to see the Northern Lights (53%), followed by a trip on the Orient Express (42%) and a journey to one of the Seven Wonders of the World (36%).

Other bucket list activities include safaris, hot air balloon rides, and going to festivals and sporting events. The survey found that 13% will be looking to volunteer for a charity post-pandemic.

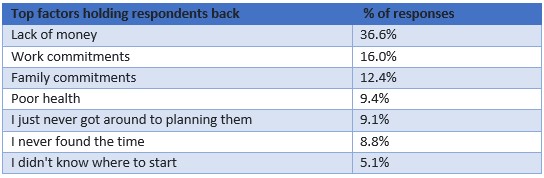

The report went on to look at the reasons people had yet to tick these items off their lists. And while 43% said that if they failed to achieve their bucket list items, they would regret it, the main reason for failing to do so was a lack of money (36%).

Other factors included work and family commitments, poor health and not knowing where to start.

The Pension Planner can help you achieve your bucket list goals

If you have accidental savings accumulated during lockdown, you might be wondering what to do with them.

As the pandemic has made clear, the unexpected can strike at any time. Be sure you have an emergency fund in place to protect you, whatever the future brings, and consider using your money to pay off high-interest debt.

With inflation high, money held in savings will likely be losing value in real terms so you might consider increasing your pension contributions. This will help enhance your retirement pot and give you the best chance of living the lifestyle you want, when you get there.

Get in touch

The earlier you start to think about and plan your retirement the better. A long-term plan means understanding what your life is like now and what you want life to be like when you retire.

Whether that includes world travel, house renovations, or relaxing on your allotment, the Pension Planner can help you put a plan in place that will make your dreams a reality. Email info@thepensionplanner.co.uk or call 0800 0787 182.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production