During this period of lockdown, your health, and that of your family, is likely to be your most important priority. However, many of you may have seen headlines over the last few weeks concerning the volatility experienced by world financial markets.

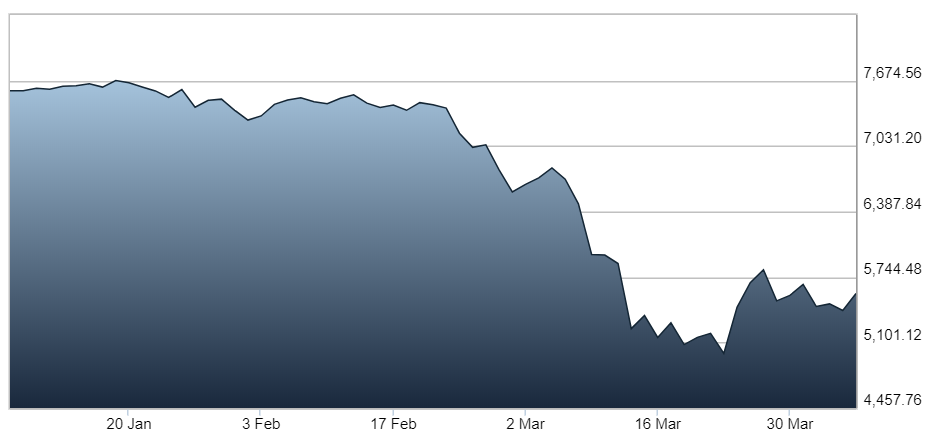

Between 7 January and 6 April 2020, the value of the FTSE 100 fell by around 26%

Source: London Stock Exchange

Other markets around the world have also seen falls. Indeed, in mid-March, both the FTSE 100 and Dow Jones suffered their biggest one-day fall since 1987.

While you may be concerned about the short-term volatility of the markets, it’s important to remain calm and focused on your goals. Here are three reasons to remain calm during periods of uncertainty.

1. Trying to time the market rarely works

You may have heard the phrase “time in the market, not timing the market.”

This seeks to explain that it’s spending time invested in markets that leads to success, not trying to time the market to buy at the bottom and sell at the top.

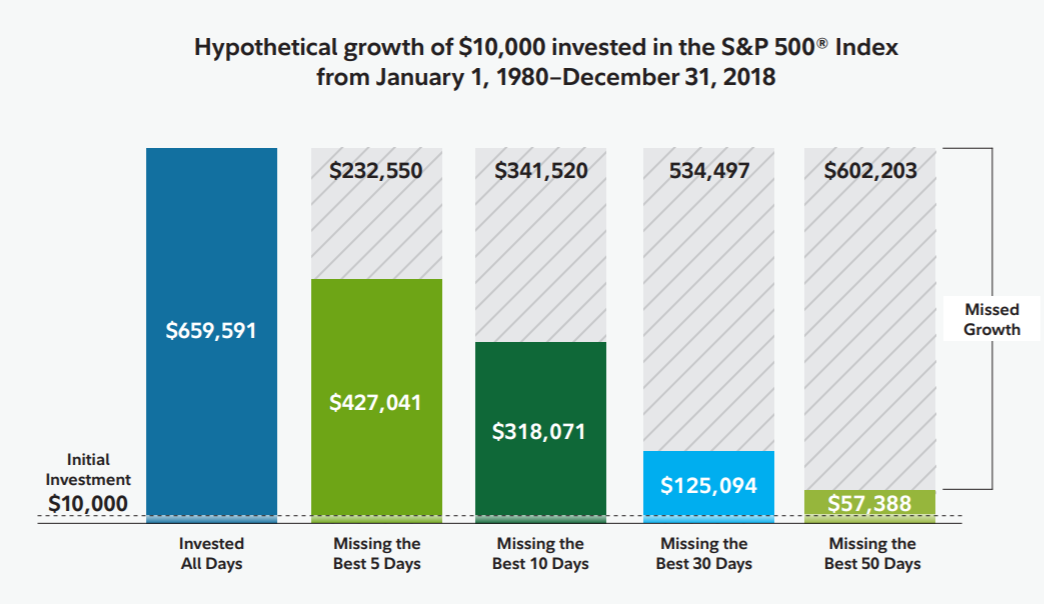

In times of market volatility, a common reaction of investors is to pull their money out of the market. The example below shows that if investors do react by pulling their money out — even for a short time — they can miss out on potential long-term growth.

Source: Fidelity

Fidelity looked at how $10,000 would have grown had you invested it in the S&P 500 Index from the start of 1980 to the end of 2018. If you had left your $10,000 invested throughout that entire period, it would have been worth $659,591 on 31st December 2018.

If you had pulled your money out of the market and you had missed just the best five days in the market during that period, your total investment would be worth $427,041. You would have sacrificed $232,550 (more than £194,000) simply by being out of the market for five days.

If you had missed the best 30 days between 1980 and 2018, your $10,000 investment would be worth just $125,094 on 31st December 2018. You would have sacrificed $534,497 of gains by being out of the market for just 30 days.

What does this mean? Trying to time when you enter and leave the market could have a significant impact on your returns.

And, selling after a fall in markets turns a paper loss into an actual loss. Imagine the value of your home had fallen in the short term. You’d be unlikely to sell it immediately and realise a loss.

2. You’re investing for the long term, and markets typically recover

Whenever you invest in equities, short-term volatility is something that you should expect and accept. Everything from retail sales to geopolitics can affect what happens to markets around the world, and prices will always fluctuate in the short term.

However, in the long term – and that’s what most of us are investing for – markets tend to offer positive returns.

Here’s the year-on-year performance of the FTSE 100 index between 2009 and 2018:

Source: IG

During this period, the compound return was 8.8% per annum. As a total return that was 121%.

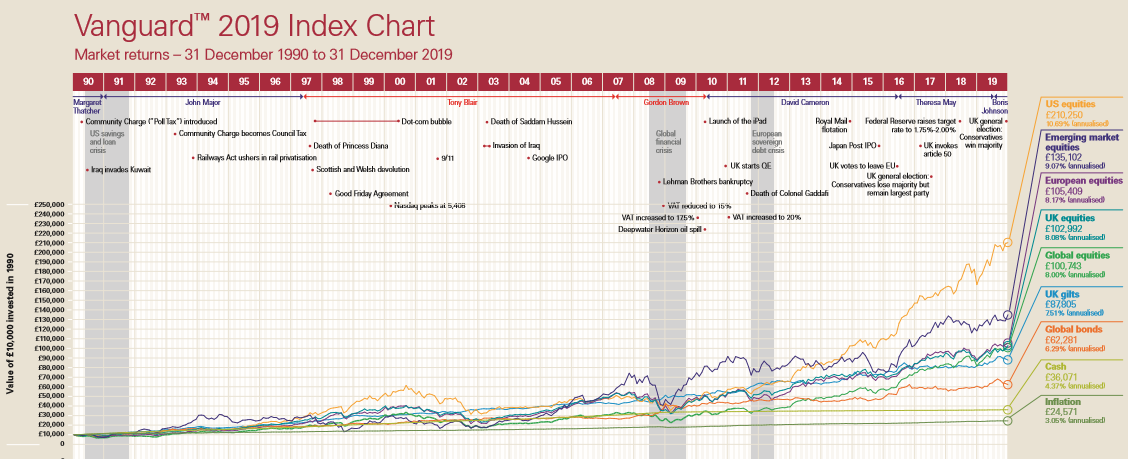

Here’s some longer-term data that also shows that it isn’t just UK equities that show growth over time. The chart below shows how £10,000 invested in 1990 has grown in the intervening 29 years in a range of investments, including UK equities, US equities and shares in ‘emerging markets’.

You’ll see that despite many volatile periods – the dot.com bubble, the global financial crisis – £10,000 invested in UK equities in 1990 was worth £102,992 on 31 December 2019, equivalent to an 8.08% annualised return.

A £10,000 investment in US equities in 1990 was worth £210,250 in 2019 – a 10.69% annualised return.

Compare this to cash, where £10,000 invested in 1990 grew to £36,071 during the same period – a 4.37% annualised return.

Notes: Cash = ICE LIBOR – GBP 3 month; global equities = the MSCI World Index; US equities = S&P 500; UK equities = FTSE All-Share; inflation = Retail Price Index, (Jan 1987=100); global bonds = Bloomberg Barclays Global Aggregate; European equities = MSCI Europe; UK gilts = ICE BofA; UK gilt (local total return) emerging market equities = MSCI emerging markets; all shown gross of taxes and of fees and in GBP.

Source: Bloomberg and Factset and Bank of England, as at 31 December 2019

Note that past performance is not a reliable indicator of future results. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

If your long-term goals are the same as they were before the coronavirus outbreak, it’s likely that your plans won’t need to change. Your goals are likely to be the same as they were a week or a month ago. Investment strategies are designed with the long term in mind, and this naturally considers periods of both positive and negative returns.

3. A diversified portfolio typically cushions any fall in stock markets

Most investors have a diversified portfolio. This means that rather than holding one single stock, or all your money being invested into equities, your portfolio is spread around a range of asset classes including shares, bonds and cash. You may also be geographically diversified, with investments in the US, Europe or emerging nations.

Diversification means that a headline fall in the value of, for example, the FTSE 100 will typically not be reflected in the value of your portfolio. Diverse portfolios that include exposure to other asset classes are designed for precisely this type of situation.

Get in touch

If you are concerned about your pension or investments in the light of recent market volatility, please get in touch. Email info@thepensionplanner.co.uk or call 0800 0787 182.

Please note:

Past performance is not a reliable indicator of future results. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

Production

Production