Since the introduction of Pension Freedoms in 2015, the days of the ‘cliff-edge’ retirement seem to be coming to an end. For many people, it’s no longer the case that they walk out of their workplace for the final time on a Friday before waking up ‘retired’ on Monday morning!

With more and more people choosing a phased retirement, it’s perhaps no surprise that the number of pensioners still in work is rising. So, just how many people are still working into their 60s and 70s? And what sort of jobs are they doing?

More than a million over-65s still working

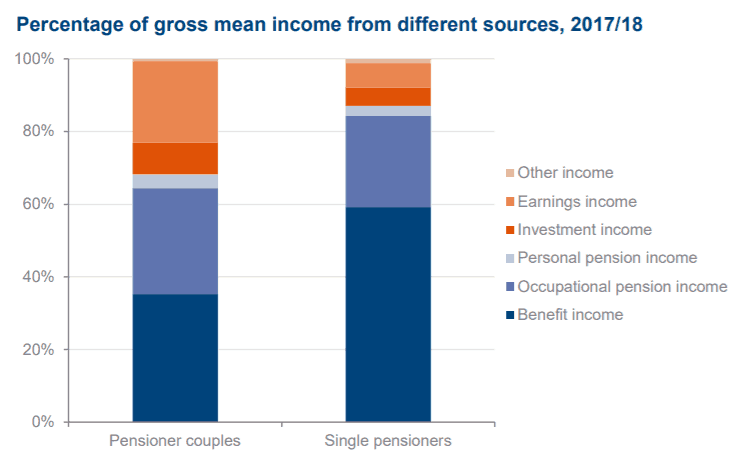

A recent report from the Department for Work and Pensions revealed that, for the average pensioner, income comes from a wide variety of sources including:

- State Pension

- Personal Pension

- Occupational Pension

- Investments

- Earnings

The study found that, for single pensioners, earnings made up 7% of their total income. For couples, that figure rises to 22%, so more than a fifth of the income of a pensioner couple comes from earnings. (Note: this figure is slightly distorted by the fact that some pensioner couples contain one adult below the State Pension age).

So, it’s clear from the figures that employed or self-employed earnings represent important income for many people.

According to the most recent data from the Office for National Statistics, just under 1.2 million people over the age of 65 were in work, equivalent to more than 10% of the entire age group.

When the figures for over-65s were first collected, in spring 1992, there were just 478,000 pensioners in work, equivalent to 5.5% of the age group. So, the proportion in employment has almost doubled in the last 25 years.

Of the over-65s who are still working, 742,000 are men. This means that almost 14% of this age group are still working, up from 8.5% in 1992.

More than 450,000 women over the age of 65 are also working; just over 7.2% of the age group. This has more than doubled since 1992 when just 3.5% of women over 65 were in work.

It’s not just people in their 60s who are continuing to work. The ONS has also revealed that the number of people aged over 70 who are still working has more than doubled in a decade to nearly half a million. The data shows that 497,946 over 70s were still in work in the first quarter of this year – an increase of 135% since 2009.

Stuart Lewis, founder of Rest Less, a site for work and volunteering opportunities specifically targeted at the over-50s, says: “While we know that the over-50s, in general, have been the driving force behind the UK’s impressive employment growth in recent years, our deeper analysis shows the hard work and significant economic contribution made by the rapidly growing numbers of over-70s in the workplace.

“Many are actively looking to top up their pension savings while they still can but there is also a growing understanding of the many health and social benefits that come with working into retirement.”

In addition, the research found, that there are currently more than 53,000 over 80s working in the UK, 25% of whom are working full-time.

So what jobs are older workers doing?

Wholesale or retail the most popular job for over-65s

The data about what jobs older workers are doing, and how many hours they do, is based on the results of the 2011 census.

The census data found that, of the over-65 workforce in England and Wales:

- 7% were employed either in the wholesale or retail trade

- 8% worked in health or social work

- 7% worked in manufacturing

- 4% worked in education

- 8% worked in professional, scientific and technical jobs.

Construction, with its physical demands, might not seem a likely fit for many over-65s, but this sector still employed 7.7% of people still working over the pension age.

The census data also shows that, overall, 57.3% of over-65s were employed part-time, and 42.7% full-time. In addition, more than a third (34.2%) of older workers were self-employed.

2 reasons older people are continuing to work

1. To enhance their earnings

Earlier we saw that earnings from work, play an important role in many people’s retirement income.

Continuing to work provides you with useful income – and remember that once you reach State Pension age you are no longer obliged to pay National Insurance contributions.

If you’re employed, then remaining in your position (even part-time) may also mean you continue to benefit from perks such as medical insurance.

2. It’s good for physical and mental health

A 2015 study of 83,000 older adults over 15 years, published in the CDC journal Preventing Chronic Disease, suggested that, compared with people who retired, people who worked past age 65 were about three times more likely to report being in good health and about half as likely to have serious health problems, such as cancer or heart disease.

And, a 2016 study of about 3,000 people, published in the Journal of Epidemiology and Community Health, suggested that working even one more year beyond retirement age was associated with a 9% to 11% lower risk of dying during the 18-year study period, regardless of health.

Need help with your retirement planning?

As people approach their retirement, they often have questions about how to structure their income – particularly if they plan to keep working. If you have any questions about your pensions and retirement planning, please get in touch. Email at info@thepensionplanner.co.uk or call 0800 0787 182.

Please note:

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change in the future.

Production

Production