As you’ll guess from our name, we’re your go-to experts if you’re planning for your retirement or if you have already retired and you need advice.

While concentrating on your pension provision is key to helping you achieve the standard of living you want in your retirement, it’s unlikely to be just your pension that funds your post-work life.

Government figures show that three in five of all retirees rely on investment income to supplement their pension income. So, it’s also important that you get professional advice on all your savings and investments, as they could end up being an integral part of your retirement planning.

60% of pensioners receive investment income

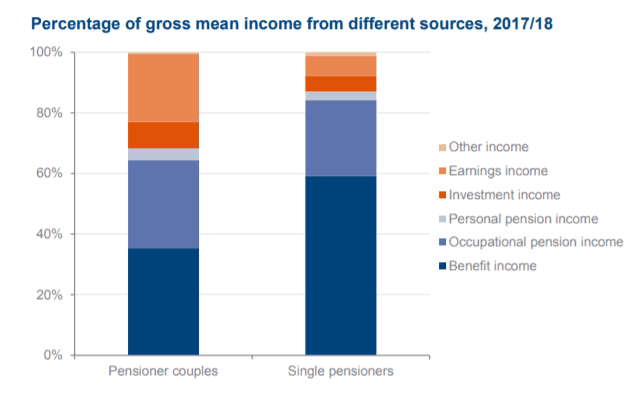

Recent Department for Work and Pensions figures show that occupational and private pensions form less than half of the average person’s income in retirement.

While most pensioners receive at least part of their income from benefits – typically the State Pension – the research shows that other sources are hugely important when it comes to enjoying a comfortable retirement.

The DWP found that 60% of all pensioners received investment income in 2017/18 while 17% of pensioners were in receipt of ‘earnings’. This demonstrates that lots of retirees are choosing to remain in employment to supplement their income.

So, besides your pension, what other ways can you generate income in retirement?

1. Savings and investments

Savings and investments are two of the most popular alternatives to pensions.

One alternative to building up a pension pot is to contribute to an ISA. You can contribute up to £20,000 in the current tax year, and ISAs offer a tax-free way to save. Cash and easy-access ISAs typically offer a fixed rate of interest and access to your money, although the returns can be disappointing, especially in a low interest rate environment.

Stocks and shares ISAs are invested and so offer the opportunity for better returns. However, there is typically an element of risk with this type of ISA, and as the value of investments and the income they provide can rise and fall, you may get back less than you invested.

A recent addition to the suite of ISAs currently available is the Lifetime ISA (LISA). A Lifetime ISA is designed to let you build up a lump sum either:

- To buy your first home

- To provide a lump sum on your retirement

You can contribute up to £4,000 a year to a Lifetime ISA, although remember that this forms part of your overall £20,000 ISA limit (so if you maximised your Lifetime ISA you could only pay £16,000 into other ISAs in the same tax year).

As well as the tax advantages, one of the other benefits of a Lifetime ISA is that the government will boost your savings by 25% of the amount that you invest.

You can contribute to a Lifetime ISA if you’re between the ages of 18 and 40, and you can keep paying in until the age of 50. You can’t withdraw the money until you reach 60 years old (unless you’re using it to buy your first home). If you do withdraw before the age of 60, you’ll pay a 25% charge and so you could get back less than you saved.

Another alternative to pensions is to consider other sorts of investments such as bonds, investment funds or investment trusts.

Investment funds or trusts, pool your savings with other investors in order to spread your money across lots of different investments (which is hard to do yourself unless you have a lot of money to invest). Many invest in stocks and shares in the UK or overseas while others invest in government bonds which are typically less volatile investments. Mixing funds, either in a multi-asset fund or in a variety of different funds, can help to diversify your portfolio.

These funds and trusts are designed to provide you with capital growth, although some also pay dividends which you can also use towards your retirement income.

Again, as these are investments, the value can rise and fall, and you may get back less money than you originally invested.

It’s important not to neglect your investments by focusing all your attention on your pension provision. We can give you independent, professional advice on your savings and investments in addition to your pension. Please get in touch by email at info@thepensionplanner.co.uk or call 0800 0787 182.

2. Property

As house prices have soared in recent years, many retirees have used the value of their home as part of their retirement planning.

Many people bought their home when they were younger and watched the value rise while they repaid their mortgage. Now, they can either downsize and move to a cheaper property, or use equity release to release cash for their retirement.

Equity release schemes can help you to benefit from the money tied up in your home, but the interest will roll up over time and so you will typically have less of an asset to pass on to your beneficiaries when you die.

Some investors have also used Buy to Let property as an alternative to a pension. The idea here is to buy a property, rent it out to generate additional income, and benefit from any capital growth over the longer term.

However, recent changes to Stamp Duty Land Tax and to the way Buy to Let income is taxed have made this less appealing to some investors.

3. Your employer’s Sharesave scheme

One low-risk way to save some additional money for your retirement is through your employer’s Sharesave or ‘save as you earn’ scheme.

Under this type of scheme, you can save between £5 and £250 per month for three, five or seven years. You’re granted a share option price at launch – typically up to 20% less than the prevailing price – and you benefit from a tax-free bonus if you complete the plan. You can then elect to buy the shares at the discounted price or take the money you have saved (if the share price has fallen).

There is typically little risk in these schemes as, if the share price falls, you’ll still benefit from the amount you saved plus a tax-free bonus.

4. Carry on working

According to recent Office for National Statistics figures published by the BBC just under 1.2 million people over the age of 65 were still in work. This is around one in ten of the entire age group.

Pension Freedoms have given retirees a range of options as to how to take their income in retirement. Increasingly, people are choosing to take a phased retirement and to continue working to generate an additional income.

Whether you are planning to go part-time, or you intend to set up your own business, continuing to work can help you maintain your standard of living. Bear in mind that this could affect your tax position, and it may also have an impact on how you decide to access your pension savings.

If you are approaching retirement and you want independent, expert advice on how to best generate the income you need in retirement, we can help. Please get in touch by email at info@thepensionplanner.co.uk or call 0800 0787 182.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This newsletter does not represent a personal recommendation and you should seek independent financial advice.

Production

Production