Your pension is one of the most important saving commitments you’re likely to make. If you want a comfortable lifestyle in retirement, you will need to contribute a significant amount into it.

A 2020 study by consumer advice group Which? found that the average comfortably retired household spends around £25,000 per year. Since the current State Pension is only around £9,000, it will be up to you to make up that difference.

When you’ve got other financial commitments to pay, such as bills or mortgage payments, it can sometimes be hard to put aside money for your pension. If you’ve been struggling to contribute enough, here are five little things you can do to save more.

1. Start early

If you’re wanting to start saving for a pension, one of the best things you can do is to start early. Whilst it is never too late to start saving for your pension, starting early can help you to save more.

The most obvious benefit of starting early is that you will need to pay less each month since you will be able to save for longer.

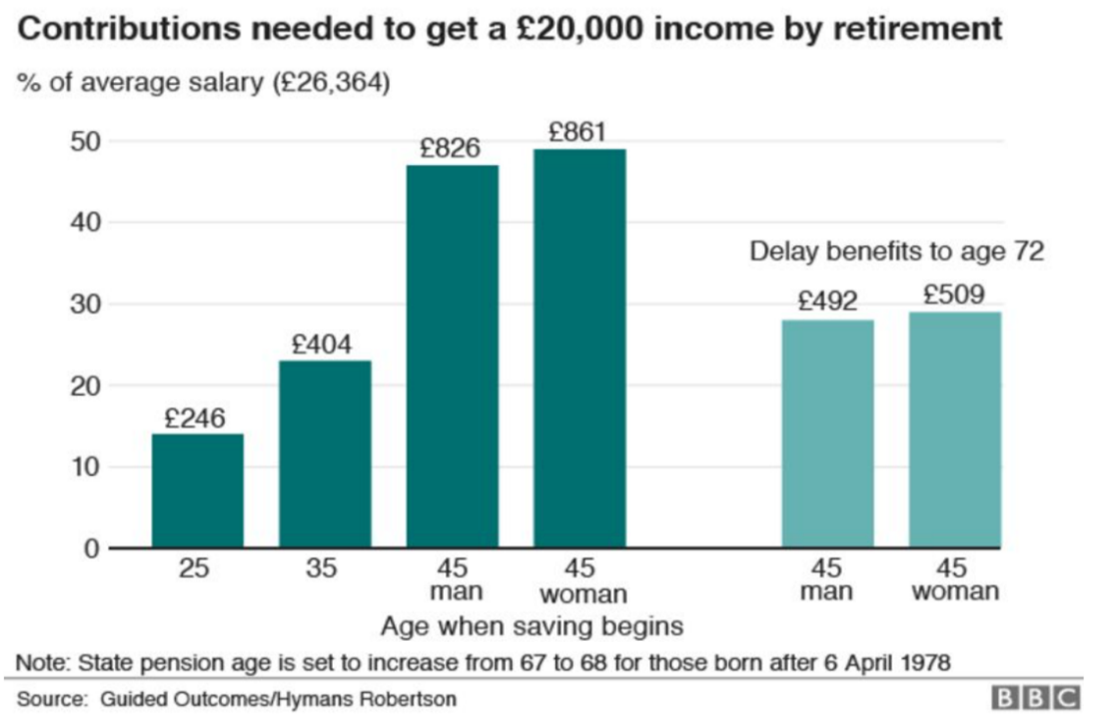

The chart below shows how much a person would need to save per month for a pension of £20,000 per year, depending on when they began saving. It also shows the percentage of their salary this amount represents.

Source: BBC

As you can see, at the age of 25 you would only need to save £246 per month – around 14% of the average UK salary. At 35, however, the pension contribution you would have to make rises to a far more significant 23%. At 45, someone on the UK’s average wage would have to pay in roughly half their salary.

This illustrates why it’s better to start saving as soon as you can, as the older you are when you begin, the greater the percentage of your income you will need to pay in to achieve the same outcome.

2. Maximise employer contributions

As of 2012, most workplaces will now automatically enrol you into a workplace pension scheme. The total minimum contribution of your salary into this pension, as of 2019, is 8%, of which 5% is paid by you and 3% by your employer.

However, some employers will increase their contribution to your pension when you increase your own. This means that if you increase your workplace pension contribution, your employer also may increase or match it.

This can be an effective way to increase your pension contributions, but make sure to discuss the details of your workplace pension scheme with your employer, as not all companies offer this.

3. Increase your contribution when a regular expense ends

If you have a regular expense, such as a car loan, take advantage of the opportunity to pay more into your pension when it comes to an end.

Since you have presumably already organised your household budget around these regular expenses, paying that money into your pension instead shouldn’t affect your quality of life.

Paying that extra money into your pension can be a great way to increase your pension contributions without making any big changes to your finances. Even if the increase in your contribution is only small, it can make a significant difference in the long term.

4. Think of your pension as an investment

It may sound strange but changing the language you use when thinking about your pension could make a significant difference in how much you pay into it.

A recent study by Scottish Widows, reported in Money Marketing, found that when participants were asked how much they wanted to ‘invest’ in their pension, rather than ‘save,’ the amount they recommended to put aside increased by 34%.

The reason behind this change in language is rooted in ‘nudge theory’ from the field of Behavioural Psychology, which is focused on positive reinforcement. According to the study, an ‘investment’ has far more positive and proactive connotations than merely ‘saving.’ and this encourages people to contribute more to their pension fund.

The difference in language is only a subtle one, but changing the way you think about your pension could make a significant difference to how much you contribute.

5. Speak to a financial adviser

If you’re struggling to find ways to pay more into your pension, you may benefit from speaking to a financial adviser. They can help you to organise your finances and ensure that you invest enough into your pension fund to support you in retirement.

This advice can help you to increase the size of your pension fund by a significant amount. According to a study by Unbiased, reported in the Telegraph, individuals who took advice on their pension at age 25 increased the size of their pension fund by an average of £34,300 more than those who did not.

Speaking to an adviser can also give you peace of mind, knowing that they are managing your money in the most effective way to provide you with the most comfortable lifestyle in retirement.

Get in touch

If you’re looking to increase your pension contributions but aren’t sure where to begin, we can help. Email at info@thepensionplanner.co.uk or call 0800 0787 182.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

Production

Production