National Savings and Investments (NS&I) made headlines in September when they announced they would cut the interest rates on a variety of its savings products, as well as reducing the odds of winning prizes in their Premium Bonds draw.

Premium Bonds have long been one of NS&I’s most popular products. But, as the odds of winning prizes reduces, many people are asking themselves whether they are still worth the investment.

If you own Premium Bonds, you may be reconsidering whether they are right for you. Read on to find out how Premium Bonds are changing and why investing could be a better alternative.

In December, the prize rate for Premium Bonds is dropping to 1% and the number of prizes on offer is being reduced

Premium Bonds work differently to other types of investment as, for every £1 bond you buy, you are entered into a draw to win a cash prize. These prizes can range from £25 to £1 million.

Unlike other financial products that NS&I offer, Premium Bonds do not offer interest. Instead, the closest thing they have to an interest rate is a ‘prize rate.’ Bear in mind, however, that if you do not win any of the available prizes, your interest rate is essentially zero.

Currently, the prize rate stands at 1.4% but this is set to drop to only 1% in December. The total number of prizes that can be won is also being reduced from 3.8 million to around 2.8 million.

This means that the odds of winning a cash prize with your Premium Bonds is set to fall drastically from 1-in-24,500 to 1-in 32,500 by the end of the year.

With this change in mind, if you own Premium Bonds you may be reconsidering whether they are still worth it. You might be tempted to keep your money in a savings account instead, but this isn’t always the most effective way to use your money.

Historically low interest rates mean savers are struggling to keep pace with inflation

Most people have been taught the virtues of saving money in the bank for a rainy day, but low interest rates mean that saving in cash could see the buying power of your money being eroded over time.

In March of this year, the Bank of England cut interest rates to a historic low of 0.1%. This cut has severely affected savers as banks and building societiesreduce the already low rates on their saving products.

Whilst saving in cash can be useful if you have a short-term goal, such as saving up for a holiday, the low interest rates offered for many savings accounts means that they are not always the best place to keep your money in the long term.

This is because of inflation, which is the rate at which money loses value. If the interest rate on your savings is lower than the rate of inflation, those savings lose value in real terms as they have their buying power eroded. According to Moneyfacts, the average interest rate on an easy access savings account in July 2020 was just 0.4%, whilst the rate of inflation was 1.5%.

If you’re looking to grow your wealth instead of keeping your money in the bank, it might be worth investing it.

Unlike saving, investing generally offers returns greater than the rate of inflation

Investing can be a good alternative to saving, particularly when interest rates are so low. Whilst it is generally advisable to keep some of your money in cash as an emergency fund, keeping too much money in cash can be detrimental for the reasons we talked about above.

Investing your money can be a good way to grow your wealth if you have a long-term goal in mind, such as saving for a comfortable retirement.

Saving in cash in an account with a low interest rate can see inflation eroding the buying power of your money while investing your money can offer returns which are higher than the rate of inflation, meaning that your investment grows with time.

Typically, if you do decide to invest it is recommended that you aim to do so for the longest period of time possible, typically five years or more, as this tends to be less risky and enables you to ride out periods of volatility in the stock market.

If you’re interested in investing but aren’t sure where to begin, you might want to consider opening a Stocks and Shares ISA. According to a report by HMRC, Brits have invested more than £330 billion in these ISAs as of 2020, making them one of the UK’s most popular investments.

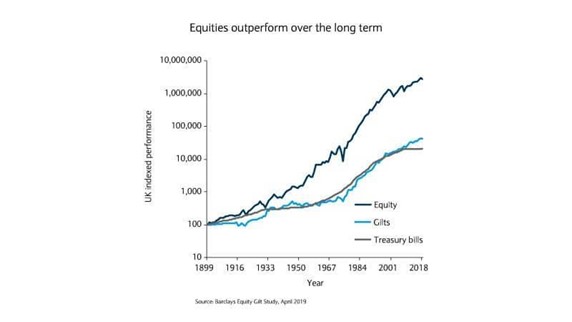

Any money that you put into a Stocks and Shares ISA will be invested in the stock market, which can see much higher returns than if you had kept the money in cash. This can be seen in the data from Barclay’s 2019 Gilt Study.

As you can see, £100 saved in 1899 would be worth around £20,000 today, but the same amount invested in equities would now be worth around £2.7 million. Investing your money, instead of saving in cash, can help your wealth grow far more effectively over the long term.

Get in touch

If you’re serious about investing your money to grow your wealth, it may be worth seeking professional financial advice. We can help you to organise your finances, helping you reach your goals while giving you peace of mind that your money is being used in the most effective way possible.

If you would like to discuss your future investments or any aspect of your long-term financial plan, please get in touch. Email at info@thepensionplanner.co.uk or call 0800 0787 182.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production